Money & Currency in Cuba

Updated: Dec 19, 2022

Updated: Dec 19, 2022

From now on, it is also possible to purchase prepaid cards to make purchases in the so-called dollar stores, where cash payments are not accepted.

Cuba has used two currencies since the mid-1990s. At the beginning of 2021, this parallel currency system, which often led to confusion, was fortunately abolished. What remained is the Cuban peso, with which package tourists rarely get in contact with. For hotel guest, it is often the easiest, to take cash and exchange it in Cuba. For individual round trips, it is preferable to use a combination of cash and credit cards. The credit cards can be used to withdraw money from ATMs and in some location also to make cashless payments. This article explains in your need to know, when it comes to money in Cuba.

For travelers who have booked a package with extensive catering in a hotel complex, it is often easiest to take cash to Cuba. Cash can be exchanged on site quite uncomplicated in hotels, banks or in one of the many exchange offices that exist all over the island. Most hotels - but also quite a few of the widespread private accommodations - have safes, so that also larger amounts of money can usually be safely stored.

ATMs & currency exchange at Havana Airport

In almost all of Cuba, it is common to pay with foreign currency. Suitable foreign currencies are primarily US Dollars and Euros, although it is easier to calculate prices in USD. However, since coins cannot be exchanged locally, only bills are accepted. When paying in euros, you have to reckon with a somewhat unfavorable exchange rate - often 1 Euro to 1 US-Dollar. In many cases, however, you will be charged a fairly accurate rate. The change is often given in Cuban pesos.

If you booked a package deal, and you plan to stay primarily in a hotel and only plan to buy a souvenir at a tourist market in Varadero, for example, you can pay quite comfortably in Euros or US-Dollars.

For individual travelers, on the other hand, it is not recommended traveling with large amounts of cash. The safest method of supplying money four round trips is a combination of cash and credit cards.

Ideally, one should be equipped with at least two credit cards and have in addition always a sufficient cash amount available.

The cash secures the ability to pay if it is not possible to get money with the credit cards. This can happen, for example, when cards are damaged or lost or if there is no ATM available or functioning.

If you do not have a credit card, you can of course travel with cash only. In this case, however, it is particularly advisable to reserve and pay for accommodation, buses or other means of transport from home. In this way, you are able to keep the amount of cash carried with you as low as possible.

­

Prepaid cards in US dollars

It is no longer possible to exchange US dollar bills for Cuban pesos. This is probably due to the reintroduced sanctions by the U.S., so that the Cuban state banks have problems to work with the greenbacks.

This new restriction only applies to the U.S. dollar, while the exchange of other currencies such as Euro, Swiss Franc or Canadian Dollar is still allowed.

As in many countries, the COVID-19 pandemic has caused a severe economic crisis in Cuba. Purchases in supermarkets can no longer be made in cash, but must be paid in USD with credit cards.

To ensure that visitors can make purchases in the so-called new dollar stores, the Cuban government has set up prepaid cards. These cards are loaded with US dollars, but cannot be purchased with greenbacks, but only with other major currencies. All this seems a bit paradox, and it is: The cards are issued in USD, while the prices are also in USD, but the cards cannot be purchased with US dollar bills.

Let's take a closer look at the terms and conditions of the new prepaid cards:

- The cards are issued by Cuba's Banco de Crédito y Comercio (BANDEC) and can only be used in Cuba. You can purchase the cards at currency exchange offices, the so-called CADECAS (details below) for a $5 USD fee.

- There are only three cards available, with denominations of 200, 500 and 1000 USD. However, the amount is non-refundable and therefore better spent during your stay.

- The cards allow cashless payments as well as free withdrawals in Cuban Pesos at all ATMs found in Cuba. For both, payments and withdrawals, you will need the security code that comes with the card.

Whether you need one of these cards depends on whether you have your own credit card and whether you plan to use it to cover your travel expenses.

­

Currencies: Cuban Peso & US-Dollar

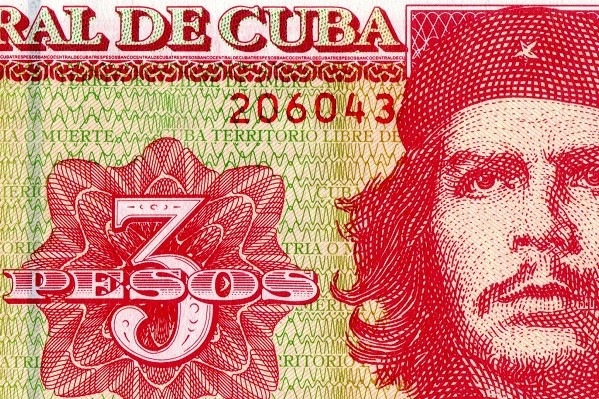

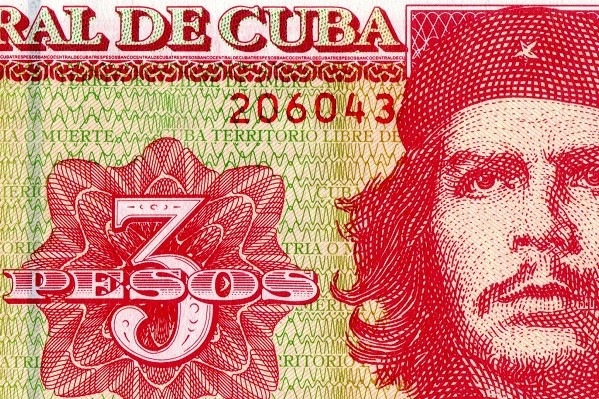

For a long time, the Cuban monetary system was somewhat bizarre, as there were two currencies. The Peso Cubano (CUP) is the Cuban national currency, often referred to as the "Moneda Nacional" (M.N.). The second currency, the Peso Convertible (C-U-C), was once created to replace the disliked U.S. dollar, which until then had been used as hard currency.

In the wake of the severe economic crisis caused by the Corona pandemic, the Peso Convertible was abolished in the year 2021, although the abolition had been planned for quite a long time. Today, the U.S. dollar is again used as a hard currency, but often only cashless, through credit card payments.

The exchange rate ratio of the Cuban peso to US-Dollar is 24 CUP per USD. This means that for one USD you will receive 24 CUP. The economically skilled traveler therefore recognizes that this is a fixed exchange rate system.

Many goods and services can be purchased with both currencies, but it must be expected that exchanges will be given in CUP.

Moreover, as described, only banknotes (bills) of the hard currencies are accepted.

­

Exchange: How to change money in Cuban Peso

If you want to take cash with you, you can take euros, Swiss francs or Canadian and US- Dollars. Ideally, you should be careful not to have the largest bills. To be on the safe side, we do not recommend banknotes with a face value of more than one hundred.

The cash can be exchanged for Cuban pesos in state-run banks or exchange offices (so-called "CADECAS" - Casa de Cambio). The network of banks and exchange offices is quite good. Even in most smaller towns, there are exchange offices, because Cubans also use them regularly to change money. Waiting times must be expected, especially in Havana. You should also be able to identify yourself, so better take your passport with you.

It is also possible to exchange money in hotels, but often at less favorable rates. At all international airports there are ATMs as well as exchange offices. It should be noted that, as in hotels, the exchange rates at airports are often a bit worse, although the difference is not particularly large.

When exchanging in exchange offices - as with ATMs (see below) - a 3% fee is charged. The fees are not shown, but result from the difference between the official USD and the used peso exchange rate. The official exchange rate is 1:24. So for one dollar, you will receive 24 Cuban pesos.

However, due to the three percent fee, travelers only receive 23.28 pesos. There are no flat fees, so regardless of the exchanged amount, only the 3% fee applies. It therefore doesn't matter whether you exchange larger or smaller amounts.

It is advisable to check carefully the amount of money you hand and receive, so you should take your time when recounting. You also should receive a bill.

Under no circumstances it can be recommended to change money on the street. Many Cubans exchange hard currencies on the black market. There is a big incentive to do so, because the unofficial exchange-rate is far better as the official (around 60:1). Foreigners should keep in mind, that private exchanges are forbidden. Besides the legal risk, you are also in the danger of getting scammed. Instead of changing on the black market, it is better to pay with a hard currency.

| US-Dollar (USD) | Cuban Peso (CUP) |

| 10 | 23.28 |

| 50 | 116.4 |

| 100 | 2328 |

| 200 | 4656 |

| 300 | 6984 |

| 400 | 9312 |

| 500 | 11640 |

­

Credit Cards in Cuba

The best and safest way to get money is by, in the best case a charge-free, credit card. First, you should check whether your bank charges fees for withdrawals abroad. In general, MASTER and VISA cards are both accepted in Cuba, but better double check with your bank. Due to US-American sanctions, issues could be caused.

For security reasons, you should limit the daily limit for foreign withdrawals before starting your trip. It is also advisable to make a note of the bank's telephone number so that the card can be blocked quickly in a case of emergency.

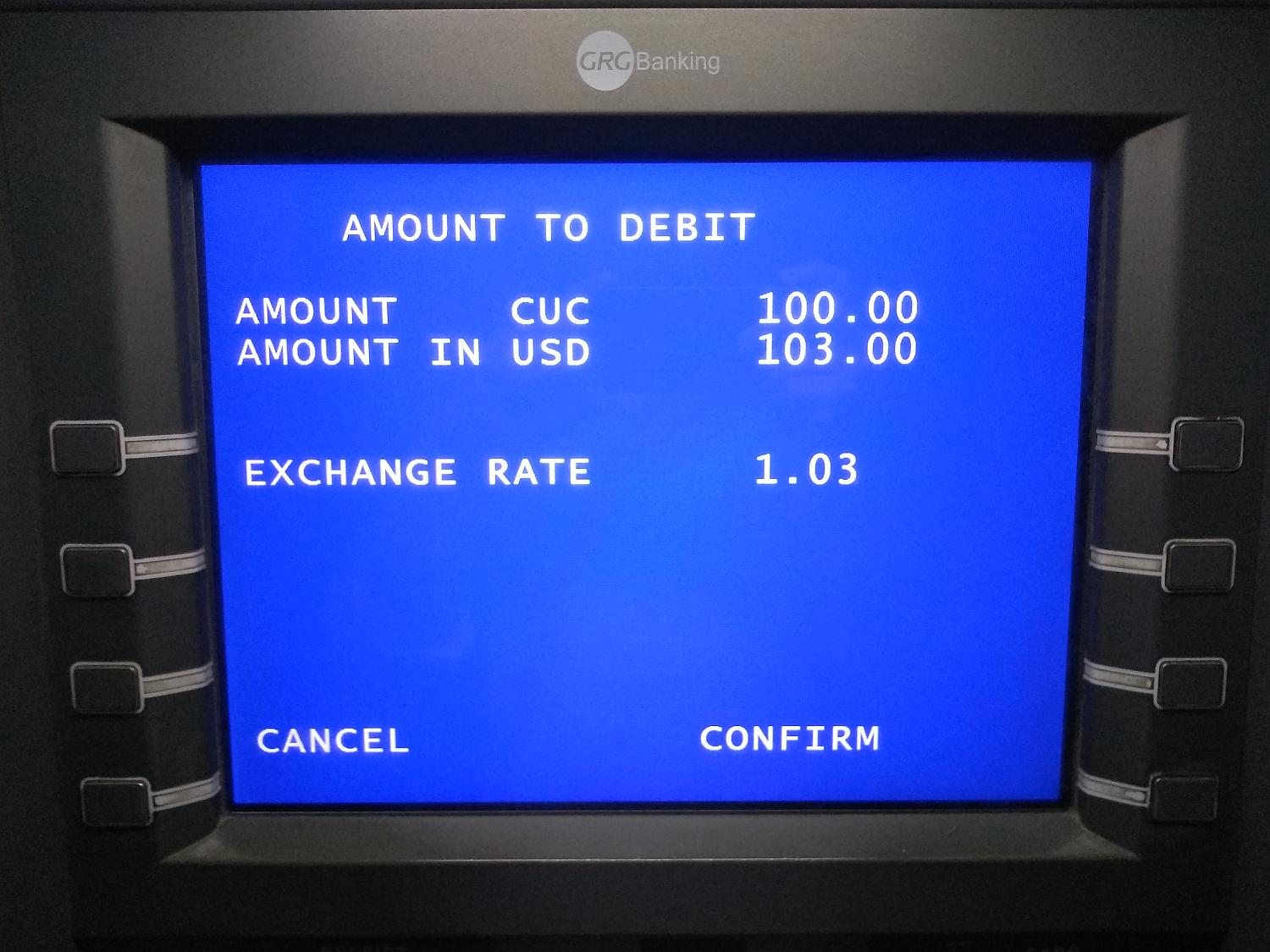

As with exchanging cash, Cuban state banks charge a 3% fee for credit card withdrawals. However, Cuban banks do not charge a flat fee. Therefore, if your own bank is not charging you a fee, small amounts can be easily withdrawn when using ATMs in Cuba.

The debit on the domestic account is in US dollars. For 2400 Cuban pesos withdrawn, the Cuban bank charges 103 USD from your account. Those whose domestic bank charges additional fees (foreign currency or withdrawal fees) have of course add these fees to the 3%.

­

Withdrawing money: How to use Cuban Atm´s

The availability of banks and ATMs is quite good, and that not only in the tourist areas. Throughout the island, money can be withdrawn at about 1000 ATMs. All ATMs are operated by state-owned banks and are generally secure. However, before inserting your card into an ATM, you should be on the lookout for manipulation, as is recommendable in all countries.

Besides this, you should have various peculiarities in consideration, when withdrawing money in Cuba:

24h ATMs in Havana (2020)

First, ATMs in Cuba only operate in Spanish and English. Second, you should know, that the available banknotes are shown on the display of the machine.

This is important, because Cubans ATMs dispense a maximum of 40 bills per disposition. If you enter an amount that exceeds the maximum amount, that the denomination does not allow, the machine will abort the process without comment and dispense the card.

If the machine is not equipped with larger banknotes, only quite small amounts can be obtained with a single withdrawal. In case you need a larger sum, you will have to withdraw money for several time or find another ATM. It should also be noted that only amounts corresponding to the available denomination can be obtained. Ideally, therefore you should better choose round amounts, such as 2400 and not 2430.

Available Notes

Another peculiarity of Cuban ATMs is the design of the withdrawal process. After the card has been inserted into the machine, the first step is to request the secret code (1.). Then you select the language (2.), withdrawal (3.) and then the desired amount (4.). After the machine has issued the amount, the card remains in the machine. Now you will be asked if you want to make another transaction. If you deny (5.), the card is finally come out.

Attention: If you forget the card in the machine, there is a risk that another withdrawal will be made during the period until the machine swipes the card, because the PIN has already been entered.

Reports from travelers about problems with swiped credit cards are probably due to this unusual - and not entirely optimal - procedure. However, if the machines are operated correctly, they usually work absolutely reliably.

Nevertheless, if possible, for security reasons, withdrawals should only be made from ATMs at open banks. If the card is retained by the ATM, it can be reclaimed immediately inside the bank. The card is returned in most cases immediately and without complications. You must be able to prove your identity. If the card cannot be returned immediately, it is advisable to block it immediately - just to be on the safe side.

Still happens: ATM out of order

It happens regularly that ATMs are out of order. This can also happen at the airport and was generally the case in the evenings and at night, at least until some time ago.

Most of the machines are now operational around the clock. As described, it is still better to get enough money during the day. If there are problems at the ATM, you can also withdraw money with your passport and credit card at the bank counter. In this case you should pay attention to the fees of your own bank.

­

Payment's in Cuba

In Cuba, you can rarely pay with credit cards. With credit cards, bills sometimes can only be settled in hotels, car rentals, supermarkets, petrol stations and a few upscale restaurants. Even with these institutions, credit card payments are often not possible. Typically, most bills will have to be paid in cash.

In almost all shops prices are marked, and you will receive a sales slip. It is advisable to check the change. Experience has shown that cheating is particularly common in tourist places. In addition, "mistakes" occur more frequently in state restaurants and shops.

Banknotes are also used for trickery.

While the products are usually on display in state stores with their prices, it is almost the rule that a product will be sold at slightly higher prices. Often it is the mineral water, because it is popular among travelers. If a product is missing a price, it can be assumed that something is wrong. In supermarkets, a price is sometimes typed into the cash register instead of scanning the product. The most common tourist traps are discussed in the safety article.

In the event of complaints, the difference is usually returned without any problems. However, the amounts that are overcharged are in most cases quite small. Many travelers will not notice this. For those who take a closer look, however, the attempts to overcharge, which can be quite frequent, can be exhausting.

With the trickery, however, one should keep in mind that the regular Cuban wages are barely enough to survive. For this reason, Cubans tip a little, even in locations where tipping seems unfamiliar to us, such as supermarkets. If the service is right and the products are prices correctly, there is nothing wrong with a small tip.

­

Tipping in Cuba

It is always advisable to have some change ready for tips. As a rule of thumb, around 10% of the invoice amount is given as a tip in Cuba restaurants. You should also tip if the bill already has 10% service charge. In cooperatives - many larger Cuban restaurants are operated as such - the 10% shown on the bill is often the regular wage of the employees.

In hotels, you should follow the international standard. A tip of one to two USD per day is appropriate for housekeeping/maids. Wealthy Cubans also tip in supermarkets and kiosks, as the employees rely on it due to the low state wages.

Unfortunately, quite a few tourists are often quite stingy, although a little tip does not burden the travel budget very much. A couple of pesos, on the other hand, help the people of Cuba, especially where there are not many tourists.

­

Reverse exchange

The export of Cuban money is officially forbidden. If you don't plan to return and still have some money left, you can exchange it in any bank, exchange office or at the latest in the security area of the airport, although the exchange rates at the airport are somewhat less favorable. Alternatively, a bottle of rum or another souvenir can be purchased in the duty-free stores at the airport (in USD).

How much money do you need?

How much money is required during the trip, of course, depends on the individual requirements and a number of other factors. Since it is advisable to reserve accommodations in advance on the Internet for individual trips, they are usually already paid. Only breakfast usually has to be paid for in cash in the private accommodation. Those who are traveling with a rental car will also have already paid most of the costs, but have to pay some additional costs on site in addition to the fuel costs.

How much money is required for transport, food & drink and other expenses in Cuba can be roughly estimated using the current prices in Cuba. However, if you have average demands, you can roughly calculate with around 50 US dollars per vacation day and person. However, frugal backpackers can also get through the day with a significantly lower budget.

If you rely on a mixture of cash and credit cards, you can keep the amount of cash low and thus travel less risky.