How To Send Money To Cuba (2022)

Updated: Dec 19, 2022

Updated: Dec 19, 2022

Anyone who wants to support people in Cuba financially has at the moment only a few options to transfer money to Cuba. Which is the best option depends, among other factors, on the amount and the time it takes for the money to arrive in Cuba. This article informs about the advantages and disadvantages of the different providers that offer a transfer to Cuba.

The easiest way to quickly transfer money to Cuba was Western Union, but this service stopped in November 2020. In the course of the current political developments in the USA, which led to a tightening of the embargo, a money transfer is also no longer possible with the providers MoneyGram, Western Union & fonmoney.

This development is regrettable. Until now, the service of these providers was often superior to a bank transfer for smaller amounts, as the fees were lower.

However, since the end of April 2021, money can be sent to Cuba again, at least with sendvalu. sendvalu delivers the money quite uncomplicated in Cuban pesos directly to the recipient in Cuba. Usually, the money should arrive at the desired address in Cuba within 3 to 5 business days, whereby all provinces of Cuba are covered. Payments can be easily made by credit card.

It remains to be seen what changes will come in this context under the new Democratic U.S. administration. At the moment, money can be transferred by bank transfer.

Another money transfer agency that offered remittances to Cuba was Small World Money Transfer. The UK-based provider sent money directly to Cuban bank accounts. The fee was a flat €8, but the first transfer was free, so it was easy to try out the service with a smaller amount. The provider has a German hotline and can therefore also be contacted by phone. However, this provider has also discontinued its service in the meantime.

A comparison of all providers transfering money to Cuba

Transfer money to Cuba from the U.S. with Western Union

With Western Union, it is possible to send money to Cuba from exclusively the U.S. When using this service, the recipients can pick up the money at over 400 agents across Cuba. Due to political restrictions, it is only possible to send up to a maximum of 1,000 USD per receiver within every 90 days.

Bank transfers to Cuba

Generally, bank transfers to Cuba are still possible. However, these are not offered by all banks and are basically complicated and also associated with quite high fees, which are especially significant for smaller amounts.

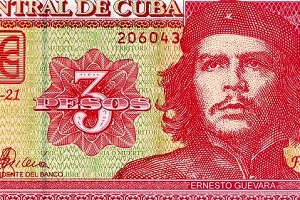

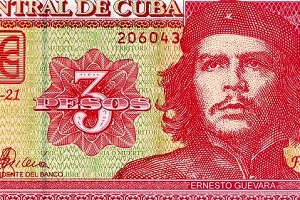

For a bank transfer, the Cuban recipient must have an account at a Cuban bank. There are different types of accounts in Cuba. It is now possible to have accounts in foreign currencies, called MLC, such as US dollar or Euro. Since many goods of daily use can only be obtained with hard currency, such an account is the means of choice.

Note: There are three different types of AIS (American International Service) cards:

- AIS Card: This is a blue card that operates in Cuban pesos. It allows cash withdrawals.

- AIS No-Cash Card: Same as the first, but as the name indicates, it is not possible to withdraw cash, but it does allow you to make payments in bars, restaurants, hotels and stores that operate in Cuban pesos.

- AIS USD Cards: A green card, it operates in USD, same as the MLC cards emitted by the other banks on the island. It allows payments at the MLC stores network and most will agree, it’s the best option to transfer money from the US.

The person you want to transfer the money will need an AIS USD Card: This means the green card, that operate in USD. The Peso cards make no sense, due to the excessive discrepancy between the official and real exchange rate. Be aware: If you send money to Peso Cards, you'll lose 75% in purchasing power.

Those who want to transfer money from their bank account to Cuba, therefore, simply enter the 16-digit Cuban account number without any addition in the transfer form, as with every other transfer. In addition, it requires the BIC/SWIFT code of the Cuban bank and the indication of the branch (»sucursal«) of the bank in Cuba, because each bank branch is assigned a specific number.

It usually does not take too long for the money to arrive to the Cuban account. Most transfers are received by the recipient in three to five business days, but sometimes the money arrives in Cuba even faster.

From Europe, transfers to Cuba are usually associated with a fee of 15 to 30 euros and thus are far from inexpensive, especially for small amounts. However, for those who wish to transfer larger amounts to Cuba quickly and securely, a bank transfer is a suitable option.

Alternatives to bank transfers

While sending money by mail is not recommended, it is entirely possible to send money to Cuba via someone visiting the island. In social networks, you can find various groups on the subject of Cuba. Who asks friendly, often find a helpful person that brings a little money personally to Cuba. However, this variant usually only makes sense if the recipient does not live too far away from the recipient, so that a handover can be easily realized.

Another, longer-term solution for money transfers is a partner card, i.e. a second credit card issued in the name of the recipient in Cuba. The credit card can then be used to make purchases in Cuba. Obviously, the card must first be brought to Cuba.

Sending money from the U.S. to Cuba

Given the current political climate between the US and Cuba, bank transfers are impossible between these two countries at the moment. But there are some alternatives. Even though transfers to accounts managed by Cuba’s state-run banks (BANDEC, BANMET, BPA), are unavailable at this time, it is possible to make direct deposits to AIS cards. The working policies of these cards allow such transfers.

What do you need to know?

- The recipient must be the owner of one of these American International Service cards

- The US resident must own international cards, such as MasterCard, VisaCard, or UnionPay.

Usually, the transfers can be made using aisremesascuba.com, but as of November 2021, the site is undergoing maintenance, nevertheless; it can be still done using the TocoPay platform. With TocoPay you can transfer money to any of the AIS cards mentioned above, with a fee of about 15% of the total amount, and the beneficiary receives the money in 3 to 7 business days.

If you live in the state of Florida and have family in Cuba, it’s possible you might have heard of Cubamax. It’s a company that started in 2001, and offers a wide variety of services, like the shipment of packages, food, money and other necessities to Cuba. With Cubamax one can transfer money directly to the MLC cards, or chose to hand-deliver the money to the recipient’s address in Cuba.

The fees vary depending on the method: for a home delivery: $20 for a transfer amount of $100, and a 20% commission for transfers over $100.

On the other hand, transferring the money directly to an MLC card is arguably quicker, with a $12 fee for transfers of $90 and a 15% commission for bigger transfers.

Conclusion

The bottom line is, that sending money to Cuba is not an easy undertaking. On the one hand, the fees are high and on the other hand, it takes time to find out the conditions of your own bank and further to get familiar with the procedure of the transfer. Currently, however, bank transfers are the best option to send larger amounts of money to Cuba.